|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

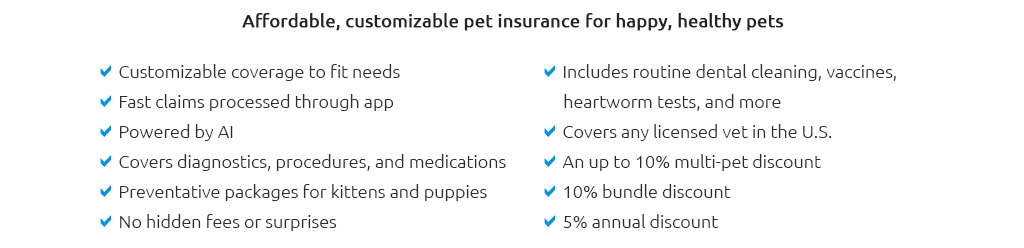

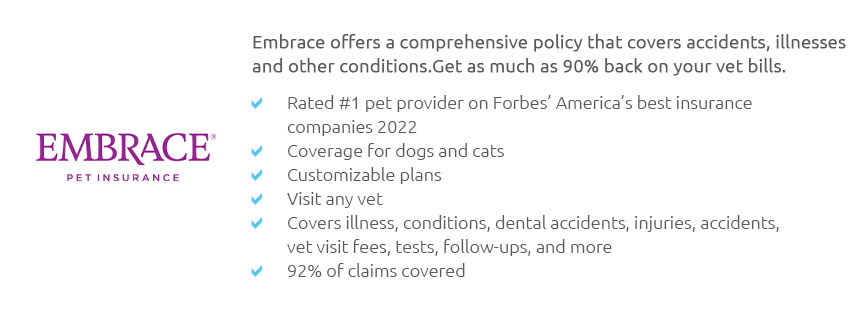

can you get health insurance for dogs - what I learned after a yearYes, you can. It's usually called pet insurance, and it mostly works as reimbursement for eligible vet bills rather than a direct discount at the clinic. It's not a human-style network plan. Terms matter: waiting periods, deductibles, coinsurance, annual limits, and exclusions shape the outcome more than the marketing does. What it actually covered for me

What it usually doesn't cover

A real-world momentSunday night zoomies, sudden limp, and we were at the emergency vet within an hour. The visit ran $2,000. My plan didn't cover the $100 exam fee. Eligible costs: $1,900. I had $200 of deductible left, leaving $1,700 reimbursable at 80%. Ten days later, $1,360 hit my bank. I still paid $640 out of pocket plus premiums, but I didn't have to hesitate over the X-rays and pain control. That part mattered. The short version of how it works

Costs and what moved my premiumMine ranged from the high $30s to low $50s per month for a young mixed breed in a mid-sized city. Age, breed risk, ZIP code, plan design, and add-ons all nudge the price. Premiums tend to rise annually with vet inflation and your dog's age. Bigger limits and lower deductibles feel comforting but cost more; I learned to price the trade-off rather than guess. Pros, cons, and outcomes I saw

Deciding yes or noIf you keep a solid emergency fund and your dog is low-risk, you might self-insure. If you want protection against the 4 - 10k surgery or a cluster of tests, a policy can steady the ground. For older dogs with existing issues, new coverage may exclude the very thing you're worried about. I treated it like a seatbelt: useful only if it's on before the crash. Quick checklist I now use

I paused. I re-read the exclusions and ran a quick "what if" on last year's bills. The math looked boring - until the ER night happened. Outcome with my dogYear one premium averaged $38/month ($456 total). That ER visit reimbursed $1,360, so I ended the year ahead even after my deductible and non-covered exam fee. At renewal the premium jumped, so I raised the deductible and landed near $40/month. Year two had no claims; I paid the premiums and moved on. Net across two years: still positive, and - more important to me - I could say yes to care without second-guessing in the moment. Transparent enough for me to keep it, but not so rosy that I expect every claim to be perfect. If you're still on the fenceGet two quotes with different deductibles, run them against one realistic emergency, and one quiet year. Pick the one whose worst-case doesn't wreck your month - and whose fine print you can live with.

|